Garments: An Industry Review

See the Garments and Textile Industry Discussion Paper PDF

The Garments and Textile Industry is one of the oldest and most important industries in the world, encompassing a wide range of activities from the production of raw materials to manufacturing, distribution, and retail. Over the years, the industry has undergone significant changes driven by advances in technology, globalization, and changing consumer preferences.

“Garments” is generally used to refer to all types of clothing items, including those that are worn for functional purposes, such as workwear or uniforms, as well as those that are worn for fashion or aesthetic purposes, such as dresses or suits. On the other hand, “apparel” refers to clothing items that are specifically designed for fashion or aesthetic purposes, and are often associated with particular styles, trends, or brands. Garments, therefore is a more generic term. While recognizing this distinction, garments and apparel are used interchangeably in this paper, except in specifically labelled charts showing the particular segment/s in the industry.

The Apparel market comprises clothing segments that are produced for private end customers and is broken down into three product lines. These are (1) Women’s Apparel, (2) Men’s Apparel, and (3) Children’s Apparel. Work clothes as well as other personal accessories such as watches and jewelry, handbags or similar items that do not count as actual articles of clothing are excluded. These three apparel product lines are further divided into 38 sub-categories.

Global Market

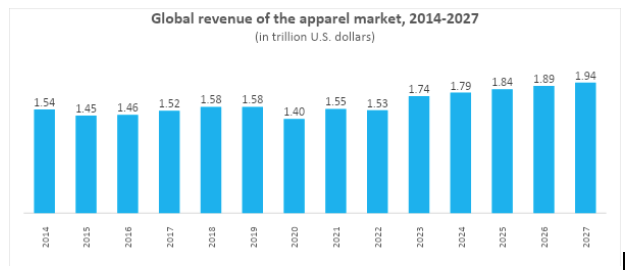

The garments industry has witnessed consistent growth worldwide. In the chart below, it is shown that the global revenue of the apparel market has been steadily increasing except for the revenue decline in 2020 to 2022 which may be due to the Covid-19 lockdowns. For the year 2023, the Industry is projected to generate a revenue of US$1.74 trillion, with an anticipated yearly growth rate of 2.84% (CAGR 2023-2027) and is expected to reach nearly US$ 2 trillion by 2027.

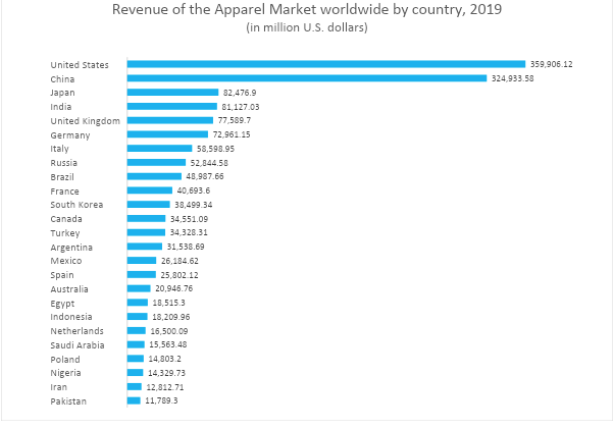

The two biggest players in the global apparel market are China and the United States. In 2019, the combined revenue of these two countries comprise nearly half (45%) of the global revenue. While the consolidated revenues from the next four countries: Japan, India, United Kingdom, and Germany, comprised just a fifth (20%) of the global apparel market.

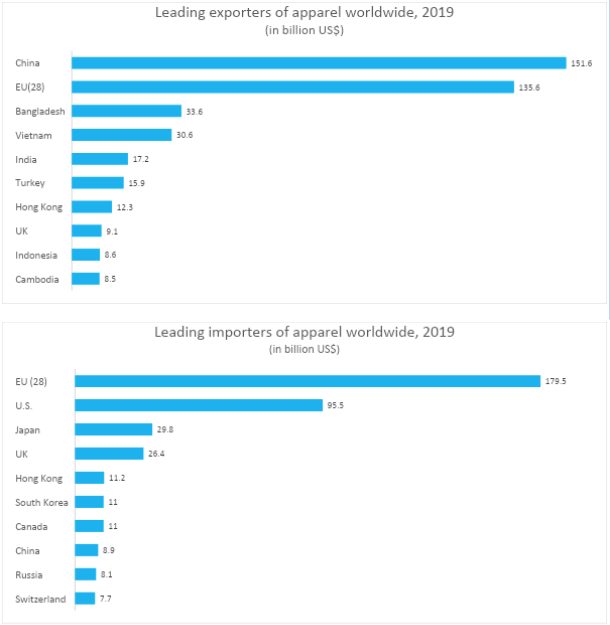

China was the leading exporting country of apparel worldwide in 2019. It was followed by the European Union, which consists of 28 countries. Exports from China and the EU represent 68% of the total apparel exports. Far third was Bangladesh, followed by Vietnam, India and Turkey. Indonesia and Cambodia also trailed among the biggest apparel exporters in the world that year.

Meanwhile, imports from the 28 countries of the European Union, together, represent 46% of the global total. This amounts to US$ 179.5 billion. The United States is the next biggest importer of apparel, with value reaching US$ 95.5 billion in 2019. Japan and the UK are the 3rd and 4th biggest importers of apparel, in the world in 2019, respectively.

Market Trends

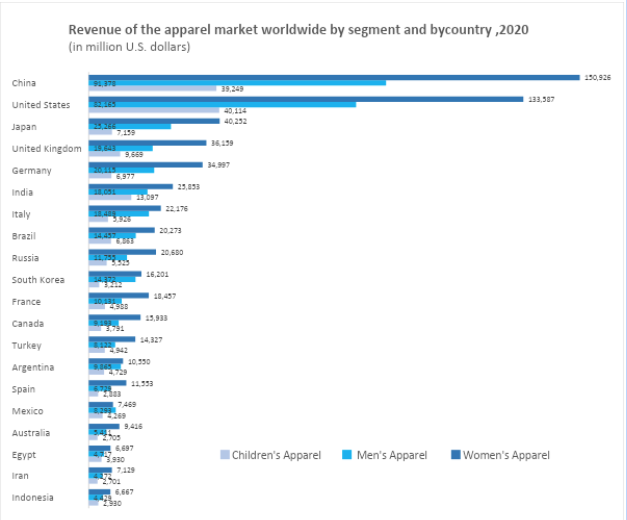

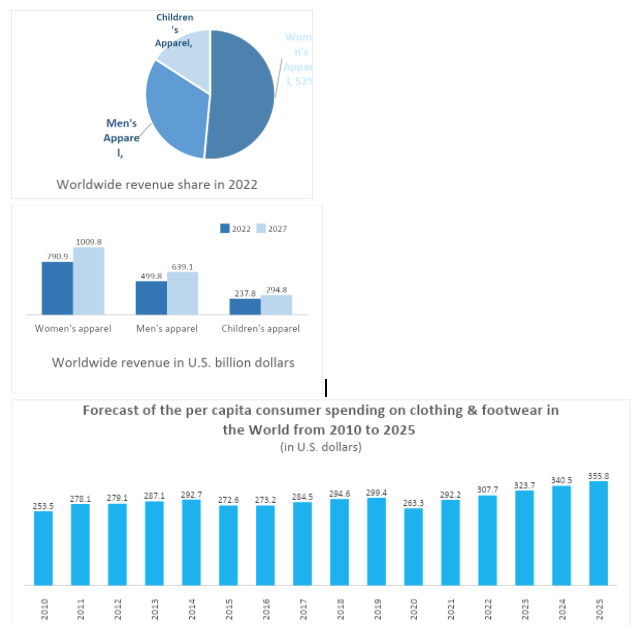

Demand for Women’s apparel dominate the industry, with 52% of global apparel revenue share in 2022 coming from this segment. It is followed by Men’s apparel, which contribute 33% to the global industry revenue in the same year, while Children’s apparel represents only 16% of world revenue. For the year 2027, it is projected that the growth of both Men’s and Women’s apparel will be at 28%. From $790.9 billion dollars in 2022, revenues in Women’s apparel is estimated to be at US$ 1,009.8 billion. Revenue in Men’s apparel meanwhile will reach US$ 639.1 billion in 2027 from US$ 499.8 billion in 2022. Children’s apparel is projected to grow by 24% in 2027. From US$ 237.8 billion in revenues in 2022, it is estimated to be US$ 294.8 billion in 2027.

Sales in the Apparel Industry is primarily driven by macroeconomic trends. Further, with spending shifting towards emerging economies, there is pressure for companies especially those in big industrial centers to diversify globally to sustain growth. While aggregate consumer demand is expected to continue to grow in the coming years, it is projected to be at a slower rate compared to other categories like food and communication.

On the supply side, other players are expected to rise from South and Southeast Asia. Bangladesh, Vietnam, India, and Indonesia are anticipated to continuously inch their way up the list of major suppliers of garments in the world owing to significantly low labor costs, access to raw materials, skilled workforce, government support, and favorable trade agreements. In addition, these emerging economies are expected to become important players in the global value chain for apparel and for textiles as companies diversify their sourcing strategies. Although China may remain to be the biggest supplier of apparel globally, increasing costs, particularly labor, might cause it to gradually diminish its dominance.

As regards consumer behavior and preferences, Statista’s Global Consumer Survey reveal that there is high interest in clothing and high brand awareness among consumers. As such, per capita consumer spending on clothing will continue to rise. However, compared to other basic expenditure items, the increase in spending on clothing (and footwear) will be less as compared to other necessities like food, water, electricity, other household staples, and even lesser than non-essential items like alcohol and tobacco.

Buyers are increasingly becoming more complicated as well, in that, while they put premium on luxury brands, they also hunt for affordable prices. This consumer complexity allows space for sellers in both ends of the price spectrum.

Growing concern about environmental sustainability likewise opens opportunities for the secondhand apparel market. This is manifested by the steady increase in market value of used apparel in the past decade which is anticipated to continue growing in the years ahead.

Emerging economies are also throwing their weight as they increase in spending. Already, they have gained control in the global clothing and footwear industry. This is clearly manifested in the drowning out of the dominant share of Europe and North America in spending on clothing and footwear in 2020 and this trend is forecasted to carry on in the coming years.

India and China have displayed high growths in the past decades and have in fact outpaced other developed economies. Their emergence along with other developing countries have been considerable and is compelling for brands to diversify their portfolio to cater to specific demands from these markets. Needless to say, most of the growth in fashion industry will come outside of Europe and North America.

As for distribution channels, they are expected to show consistent trends. Online sales or purchases concluded via the internet (on a desktop, PC, tablet, or smartphone) will persist in the years ahead. The share of online purchases compared to those done in stationary stores have in fact nearly doubled since 2017. It is also worth noting that social media drives sales as many consumers report having made purchases after an item had been advertised to them by influencers.

Channel Convergence and Fast Fashion are key drivers of the global clothing industry. Channel convergence refers to the merging of different marketing and sales channels to a holistic brand experience across physical and digital presences. Fast fashion, on the other hand, refers to a business model that focuses on producing and selling at low cost, large quantity, and trendy designs at fast speed. Inditex, H&M, TJX, Fast Retailing and Gap are the key players in this model.

The Textiles Industry

The Textiles Industry, on the other hand, includes preparation and spinning of textile fibers as well as textile weaving, finishing of textiles and manufacture of made-up textile articles, except apparel.

In 2020, the world textile market was valued at over $800 billion. It accounted for 2% of the global GDP. Nearly half (48%) of the global supply of textiles come from China. Other top exporters of textiles in the world are India (4.7%), Germany (4.3%), and Turkey. (3.6%). The United States, on the other hand, is the top importer of textile in the world, importing 14.9% of the global supply. It is followed by Germany and Vietnam. China only imports 4.7% of the global supply of textiles. More than two-thirds of the global supply of textiles are dispersed in different parts of the world.

Textiles is a complex sector, requiring a wide range of materials like cotton and other natural fibers. Some textiles are derived from animals like wool and silk. Synthetic fibers that are produced through chemical processes and are not directly derived from natural sources are also widely used in the industry. Raw materials are sourced mainly from India, China and Brazil, which are then transported to other countries for processing.

The top textile industry company in 2021 in terms of revenue generated was Japan’s Toray Industries. Toray was founded in 1926 and has since expanded globally with over 300 subsidiaries and affiliates in 27 countries. It manufactures textiles, fabrics, and other products. Most notable are Ultrasuede, a synthetic suede material used in fashion and interior design and Lumirror, a high-performance polyester film used in packaging, etc. In 2021, Toray posted US$ 20.3 billion in revenues.

Following Toray in terms of revenue generated are Zhejiang Construction Investment Group Co. Ltd. in China and Mohawk Industries in the United States. These companies posted US$ 11.5 billion and US$ 11.2 billion in revenues in 2021, respectively.

In terms of number of employees, meanwhile, China’s Sinopec Oilfield Service Corp. lead the textile companies in the world, with 69,232 employees. Toray and Mohawk are second and third, with 48,842 and 43,000 employees, respectively.

Production of textile is a resource-intensive process, thus causing severe impact on the environment. The industry was postulated to be one of the major contributors of greenhouse gas emissions. Since some materials are made from natural fibers, it was also blamed for deforestation in some countries. In Brazil, for instance, parts of the Amazon rainforest were cleared for cultivation of cotton. Vast lands in India were also used for cotton production, which was posited to have caused deforestation and water scarcity in some parts of the country. The production of viscose, a type of regenerated cellulose fiber made from wood pulp, was also presumed to have led to clearing of forest lands in China. The same was alleged against Indonesia, one of the largest producers of palm oil, which is also used in processing viscose.

Market Trends and Challenges

The global textile market is driven by a number of factors. Foremost is the increased demand for apparel particularly in developing countries. Another factor is the higher concentration of retail stores. The increase in disposable income and rapid urbanization are also contributing to the rise in demand.

Since the production of textile uses intensive amounts of land, water, energy, and chemicals, it is hounded with ethical and sustainability issues. These concerns brought forth focus on sustainable and ethical fashion. Fashion brands that adopted sustainable and ethical practices like using recycled or organic materials, waste reduction, and improving working conditions in their supply chains are more patronized.

The line graph below shows the market share attributable to sales of sustainable apparel goods for each year. Sustainable here means products that are being sold by companies which are using sustainable input factors and transparently disclose their environmental and social practices. As illustrated, the last decade has shown an increasing trend and is projected to continue.

Challenges and Opportunities

Recent global events threw immense challenges to the industry. The COVID-19 pandemic and the closing of borders of countries disrupted the global supply chain resulting to raw materials shortage. The lockdowns also dampened consumer demand, resulting to the closing down of many retail outfits.

The lingering war in Ukraine is of high concern to both the garments and textile industry, as well. It disrupted trade routes and triggered an energy crisis that will continue to have an impact to the industry. Extreme weather is also negatively affecting supply chains and availability of raw materials across Asia. Furthermore, the differences in shopping habits of low- and high-income households will become more pronounced, as cost conscious customers are likely to cut back or trade down. Meanwhile, shoppers for luxury items will likely continue to spend largely as they have been insulated from the impact of the economic slowdown.

Despite these challenges, the garments and textile industry remain a key driver of the global economy. The industry has a long history of innovation and adaptation, and there are many opportunities for businesses to innovate and improve their practices to create a more sustainable and ethical future for the industry.

Industry Innovations

The garments and textile industry are pulsating and are undergoing remarkable transformation driven by groundbreaking innovations that blend fashion with cutting-edge technology. From sustainable materials to smart fabrics, these advancements are revolutionizing the industry, bringing forth a new era of creativity, functionality, and sustainability.

Circular Economy for Fashion

In response to growing environmental concerns, designers and researchers are developing sustainable materials that reduce the industry’s ecological footprint. Abiding by the ideals of a circular economy, the new business model in fashion defies the traditional design and production processes by emphasizing durability, repairability, and recyclability. Designers are encouraged to create garments that last longer and made to be made again using safe and renewable inputs. Companies that subscribe to circular economy in fashion utilize durable materials and construction techniques. By implementing innovative design strategies, such as modular or multifunctional clothing, the industry can reduce waste and extend the lifecycle of products.

A circular economy mindset entails embracing sustainable material choices that includes utilizing organic and regenerative fibers, recycled materials, and innovative alternatives like bio-based or lab-grown textiles. Innovations include the use of organic cotton, recycled polyester, and alternative fibers like hemp and bamboo. By incorporating these materials into the production cycle, fashion brands can minimize resource consumption, reduce carbon emissions, and lessen the reliance on non-renewable resources, all while maintaining high-quality standards and aesthetics.

In this model, the focus of fashion shifts from disposability to durability. It decouples revenue from production and resource use. Repair, reuse, and reselling initiatives are encouraged- enabling consumers to extend the lifespan of their garments. Platforms are born to offer repair services, garment swaps, and resale and promote a more sustainable consumption pattern, thus reducing the need for constant production and minimizing clothing waste.

Some examples of these sustainable fashion platforms are Swap.com, Vinted, Refashioner, Swap Society, ThredUP, and Segunda Mana. These are online marketplaces or thrift stores that offer clothing exchange or donation facility, etc.

Swap.com allows users to swap clothing, accessories, and other items. Users can create listings for items they want to trade and browse through the available items to find something they like. The platform facilitates the exchange process, including shipping labels and tracking. In ThredUP, users can order a box of secondhand clothing based on their style preferences, then try on the items at home, and keep what they like while returning the rest.

Swap Society is a subscription-based clothing swap service where members can swap their pre-loved clothing items and receive “points” that can be used to request other items available on the platform. Refashioner focuses on designer and high-quality clothing swaps; and in Vinted, users can create listings for items they want to swap, search for items they desire, and connect with other users to arrange swaps or purchases. The social enterprise initiative of (the Philippines’) Caritas Manila called Segunda Mana, meanwhile, emphasizes the concept of giving a second life to pre-loved items. It operates as a donation and retail program that collects various items, including clothing. These donated items are then sorted, cleaned, repaired (if necessary), and sold at affordable prices in Segunda Mana thrift shops or through partner outlets.

Implementing effective recycling and upcycling systems is vital in the circular fashion economy. Garments that have reached the end of their lifecycle can be recycled into new fibers or transformed into entirely new products. Furthermore, upcycling techniques involve creatively repurposing materials to give them new life and value. By diverting textiles from landfills and closing the loop on production, the fashion industry can significantly reduce its environmental impact.

The circular economy represents a fundamental shift in the fashion industry, paving the way for a more sustainable and responsible future. By reimagining design processes, embracing sustainable materials, extending product lifespans, and implementing effective recycling systems, the industry can move towards a closed-loop system that minimizes waste and maximizes resource utilization.

Fast fashion company and one of the biggest in the industry, H&M, have embraced this model when they started their Take Care Initiative. This program enables their customers to prolong the life cycle of their clothes. They also have in-store garment collection and recycles them. They introduced clothes rental, pre-owned options, and invested in fabric recycling.

In the textile industry, meanwhile, leading international organizations developed the Global Organic Textile Standard (GOTS). It is the worldwide leading textile processing standard for organic fibers. GOTS sets strict criteria for both environmental and social aspects of textile production, including the processing, manufacturing, packaging, labeling, trading, and distribution of organic fibers. The standard covers the entire textile supply chain, from the harvesting of raw materials to the final product.

Smart Fabrics, 3D Printing and Nanotechnology

Smart fabrics, also known as electronic textiles (or e-textiles), incorporate technology seamlessly into garments, opening up a world of possibilities. These fabrics are embedded with sensors, microchips, and conductive threads, enabling functionalities like temperature regulation, health monitoring, and even interactive designs. For instance, smart fabrics can adjust their thermal properties based on external conditions or monitor vital signs for athletes or patients, enhancing both comfort and well-being.

The convergence of fashion and technology has likewise given rise to wearable technology, which integrates electronic components into garments and accessories. Examples of wearable technology are smartwatches, fitness trackers, and even garments with integrated lighting systems or haptic feedback. These innovations enhance functionality, connectivity, and personalization, creating a new realm of possibilities for fashion and self-expression. Adafruit and Wearable X, are electronic textile pioneers that specialize in providing components and tools for DIY enthusiasts and makers interested in creating their own smart textiles. These companies offer conductive fabrics, thread, sensors, and micro-controllers to enable the integration of electronics into fabrics.

Astroskin, developed by the company Hexoskin, offers state-of-the-art real-time biometric monitoring of the five vital signs and provides good readings as an ambulatory heart monitor with breath sensors, a pulse oximeter, and a skin temperature sensor all embedded in one washable garment, and headband that replaces a finger pulse oximeter.

Advancements in 3D printing technology have also trickled down to the garments and textile industry by enabling the creation of complex and customizable designs with ease. Designers can now create intricate patterns, textures, and structures directly using 3D printers, eliminating the need for traditional manufacturing processes. Digital textile printing, on the other hand, allows for high-resolution, vibrant designs to be directly printed onto fabric, eliminating the need for multiple dyeing and washing processes. It enables faster production, reduces water and energy consumption, and provides designers with endless creative possibilities.

Nanotechnology is making significant strides in the textile industry, too, offering improved performance and functionality. Nanoparticles can be applied to fabrics to enhance properties such as water repellency, stain resistance, and UV protection. Additionally, nanotechnology enables the development of self-cleaning fabrics that repel dirt and odor, reducing the need for frequent washing and extending the lifespan of garments.

Overall, innovations in garments and textiles are propelling the industry into an exciting future, one that is sustainable, technologically advanced, and increasingly personalized. As these innovations continue to evolve, we can anticipate a world where fashion seamlessly integrates with technology, offering us unprecedented levels of comfort, functionality, and style while minimizing the environmental impact of the industry.

The Philippine Garments Industry

The Garments Industry plays a significant role in the Philippine economy. In 2019, according to the Philippine Statistics Authority’s Annual Survey of Philippine Business and Industry (ASPBI), there are 836 enterprises in the sector providing employment to 107,697 Filipinos. The number of enterprises has sadly been decreasing the past years although employment in the sector have been slowly on the rise except for the slight decrease in 2019.

The industry has a significant focus on exports. The country is known for producing quality garments for global brands and retailers. Garments companies in the Philippines benefit from trade agreements, such as the Generalized System of Preferences (GSP), which provides preferential access to markets like the United States and the European Union. Some of the main export destinations for Philippine garments include the United States, Japan, Europe, and Australia.

While Philippine exports have been increasing however slowly in the past two decades, the export value of garments has not kept pace. And, although there were some years of spike (2001, 2006, 2011, and 2014) these have not been enough to modify the trend from a gradual downfall. In 2000, export of garments amounted to Php 115.7 billion. Yet, in 2020, it was valued at only Php 34.4 billion, posting a 70% decline compared to the export value at the start of the second millennium. Although the sector showed recovery in 2021 and 2022, these have been miniscule.

A significant destination of Philippine garments is Japan where nearly a third of the industry export goes. As in the general trend of the country’s garment exports, the country’s exports to Japan have also been declining.

The top apparel product that the country exported to Japan in 2021 according to the Department of Trade and Industry – Export Management Bureau (DTI-EMB) was Pantyhose and tights, of other textile materials, knitted or crocheted; which represent 32% of the total. The other top apparel products exported to Japan are shown in the graph above.

The biggest fashion brands/retailers in the country are Penshoppe and Bench followed by the global brands H&M and Uniqlo. The ranking was done by YouGov BrandIndex based on index score measuring quality, value, satisfaction, recommendation, and reputation over a period of 12 months. Others in the list include Oxygen, Forever 21, Gap, Zara, Mango, and Aeropostale.

Looking at the demand side, the share of per capita expenditure for clothing and footwear is very small- 2.5%, compared to food items which constitute 42.6% of the expenses of Filipinos in 2018. Despite its small share in per capita spending, total consumer behavior has been promising. It has steadily increased in value. In 2013, total spending on clothing and footwear was only at US$ 4,978.38 million but growth has been consistent and it is projected to more than double by 2028.

Philippine Textile Industry

The Philippines has a long-standing tradition of textile production, with indigenous communities weaving intricate fabrics using natural fibers like abaca, cotton, and piña (pineapple fiber). Spanish colonization introduced silk production, and subsequent periods saw the influence of different cultures on textile production techniques and designs.

The country has access to a diverse range of raw materials suitable for textile production. These include natural fibers like cotton, abaca, pineapple, and silk, as well as synthetic materials like polyester, nylon, and rayon.

The value chain of the textile and fashion industry is shown in the illustration in the next page. The process starts with the production of raw materials which includes natural and synthetic fibers then components and assembly, which involve yarn, spinning, knitting, weaving, dyeing, printing, cut and finishing processes. Logistics and Sourcing comprise final assembly that entails sewing, pressing, buttoning, etc.; and distribution, which engages clothing companies, the different brands and overseas buyers. This overlaps with Design, Sales and Branding, which refers to the design, marketing and sales and entails the participation of department stores, specialty stores, chain stores, plus the online platforms. The Major textile (and garments) manufacturing hubs are located in Metro Manila, North and Central Luzon, CALABARZON, Cebu, and Davao. The textile mills and factories are primarily located in industrial zones. However, there are also small-scale operations involved in textile production, particularly for indigenous fabrics and traditional handwoven textiles.

The country has a strong base of skilled and semi-skilled workers, making it an attractive destination for textile and garment production. The industry is a major source of employment in the Philippines, particularly for women. The sector provides job opportunities in various stages of the value chain, from production to design, sales, and branding.

According to the 2016 data from the International Labor Organization (ILO), the combined garments and textile industry provides employment to 384,600 people of which, nearly 75% are women. However, the Confederation of Wearable Exporters of the Philippines gives a much higher estimate of 1.1 million jobs that could be attributed to the sector in 2019.

Various initiatives have been implemented to support the industry’s growth and competitiveness. This includes providing incentives to textile manufacturers, promoting research and development, fostering collaborations between industry stakeholders, and supporting the preservation and promotion of indigenous textiles. Yet, the industry continues to struggle fighting off gradual decline due to lack of competitiveness.

According to an expert’s observation, textile firms’ failure to modernize equipment, the absence of strong linkages between textile industry and garments industry, the unrestrained entry of surplus imports (including smuggled textiles), and firms’ general lack of preparedness for economic liberalization have been the sector’s doom.

Local garment firms are struggling against other Asian garment companies. Philippine enterprises have not been as competitive in terms of wages, pricing, quality and delivery of export garments. They are focused on one aspect of garment production (assembly or the cutting and sewing of garments using imported materials) instead of doing all stages of production like the practice of other Asian garment firms. Investors prefer investing in countries where all the stages of garment production are done. The country has not been an attractive manufacturing site which was further aggravated by its low labour productivity.

To address these conundrums, several possible paths for growth may be considered including looking at the possibility of doing all the stages of production starting from the production of raw materials. Firms also need to have a good understanding of changing consumer preferences. In recent years, there has been an increasing focus on sustainability and ethical practices within the industry. Manufacturers and brands may consider adopting eco-friendly production processes, using organic and recycled materials, and promoting fair trade practices. Firms may likewise strengthen and sustain linkages and collaborative competition. Partnerships with universities can establish collaboration on research projects. This allows businesses to leverage the expertise and resources available in academic institutions, such as state-of-the-art laboratories, research facilities, and a pool of talented researchers. By working together, businesses can gain valuable insights, develop innovative solutions, and address industry-specific challenges.

References:

2014 Annual Survey of Philippine Business and Industry (ASPBI) – Manufacturing Sector for All Establishments: Final Results. Philippine Statistics Authority. (2017, April 29). https://psa.gov.ph/content/2014-annual-survey-philippine-business-and-industry-aspbi-manufacturing-sector-all

2015 Annual Survey of Philippine Business and Industry (ASPBI) – Manufacturing: Final Results. Philippine Statistics Authority. (2018, June 8). https://psa.gov.ph/content/2015-annual-survey-philippine-business-and-industry-aspbi-manufacturing-final-results

2016 Annual Survey of Philippine Business and Industry (ASPBI) – Manufacturing Sector: Final Results. Philippine Statistics Authority. (2019, July 19). https://psa.gov.ph/content/2016-annual-survey-philippine-business-and-industry-aspbi-manufacturing-sector-final-results

2017 Annual Survey of Philippine Business and Industry (ASPBI) – Manufacturing Sector: Final Results. Philippine Statistics Authority. (2020, March 9). https://psa.gov.ph/content/2017-annual-survey-philippine-business-and-industry-aspbi-manufacturing-sector-final-results

2019 Annual Survey of Philippine Business and Industry (ASPBI) – Manufacturing Sector: Preliminary Results. Philippine Statistics Authority. (2022a, May 10). https://psa.gov.ph/content/2019-annual-survey-philippine-business-and-industry-aspbi-manufacturing-sector-preliminary

About Swap Society. Swap Society. (n.d.). https://www.swapsociety.co/pages/about

Adafruit Industries, Unique & Fun DIY electronics and kits. Adafruit Industries. (n.d.-a). https://www.adafruit.com/about

Amed, I., Balchandani, A., Berg, A., Harreis, H., Hurtado, M., Petersens, S. af, Roberts, R., & Altable, C. (2022, May 2). State of Fashion Technology Report 2022. McKinsey & Company. https://www.mckinsey.com/industries/retail/our-insights/state-of-fashion-technology-report-2022#/

A new textiles economy: Redesigning Fashion’s Future. Ellen Macarthur Foundation. (n.d.). https://ellenmacarthurfoundation.org/a-new-textiles-economy

Apparel Market Worldwide. Statista. (2023). https://www.statista.com/study/54163/apparel-retail-worldwide/

Application of nanotechnology in textile industry, nanotechnology application in textiles. Fibre2Fashion. (2013, October). https://www.fibre2fashion.com/industry-article/7135/application-of-nanotechnology-in-textile-industry

Asia Pacific Economic Cooperation. (2018, October). Enhancing the Competitiveness of Women-led MSMEs in the Garments and Textile Sector through Innovation and Entrepreneurship. APEC. https://www.apec.org/Publications/2018/10/Enhancing-the-Competitiveness-of-Women-led-MSMEs-in-the-Garments-and-Textile-Sector

E-textiles class kit. Adafruit Industries. (n.d.-b). https://www.adafruit.com/product/3673

Fespa. (2021, June 28). The environmental benefits of Waterless Digital Textile Print Ink Systems. FESPA. https://www.fespa.com/en/news-media/features/the-environmental-benefits-of-waterless-digital-textile-print-ink-systems

Global Standard gemeinnützige GmbH. (2020, March 1). Global Organic Textile Standard (GOTS) version 6. Global Organic Textile Standard. https://global-standard.org/images/resource-library/documents/standard-and-manual/gots_version_6_0_en1.pdf

Hexoskin. (n.d.). Astroskin. Hexoskin. https://www.hexoskin.com/pages/astroskin-vital-signs-monitoring-platform-for-advanced-research

Highlights of the Philippine Export and Import Statistics January 2022 (Preliminary). Philippine Statistics Authority. (2022b, March 11). https://psa.gov.ph/content/highlights-philippine-export-and-import-statistics-january-2022-preliminary

Household Final Consumption Expenditure. Philippine Statistics Authority. (2023a, May 11). https://psa.gov.ph/national-accounts/base-2018/data-series

Ikat. Narda’s Handwoven Arts & Craft. (n.d.). https://www.nardas.com/category/fabrics/ikat-garments/

ILO. (October 10, 2017). Employment in the garments industry in the Philippines in 2016, by gender (in 1,000) [Graph]. In Statista. Retrieved May 18, 2023, from https://www.statista.com/statistics/798080/garments-industry-employment-by-gender-philippines/

Jocson-Agoncillo, M. (n.d.-a). Manufacturing and Sourcing Opportunities in the Philippines for Wearables. Confederation of Wearable Exporters of the Philippines. https://www.asean.or.jp/ja/wp-content/uploads/sites/2/CONWEP-ASEAN-Japan.pdf

Kim, S., Seong, H., Her, Y. et al. A study of the development and improvement of fashion products using a FDM type 3D printer. Fash Text 6, 9 (2019). https://doi.org/10.1186/s40691-018-0162-0

Kubota, T. (2021, August 19). Wearable Technology Research at Stanford. Stanford . https://news.stanford.edu/2021/08/18/wearable-technology-research-stanford/

Materials change our lives. Toray Industries, Inc. (2023, May 15). https://www.toray.com/

Materials dashboard. Textile Exchange. (2022, December 5). https://textileexchange.org/materials-dashboard/

Navo, N. (2021, March 4). What is circular economy?. Institute for Small-Scale Industries. https://beta.entrepreneurship.org.ph/2021/03/04/what-is-circular-economy/

Nelen, J., & Agarwal, S. (n.d.). Future-Proofing Sustainable Fashion via digitalisation and transparency. PwC. https://www.pwc.nl/en/insights-and-publications/services-and-industries/retail-and-consumer-goods/future-proofing-sustainable-fashion-via-digitalisation-and-trans.html

New Program promotes using organic T-shirts for marketing. OTA. (2014, September 16). https://ota.com/news/press-releases/17142

Organic cotton: It’s better for the environment, and here’s why. OTA. (n.d.). https://ota.com/organic-cotton-it%E2%80%99s-better-environment-and-here%E2%80%99s-why

2018 Family Income and Expenditure Survey. Philippine Statistics Authority. (2020). https://psa.gov.ph/sites/default/files/FIES%202018%20Final%20Report.pdf

Philippines: Garments Industry Employment by gender 2016. (2022, May 12). Statista. https://www.statista.com/statistics/798080/garments-industry-employment-by-gender-philippines/

Philippine Statistics Authority. (June 18, 2019). Textile manufacturing value added as a share of GDP in the Philippines from 2009 to 2018 [Graph]. In Statista. Retrieved May 22, 2023, from https://www.statista.com/statistics/1017652/value-added-share-textile-manufacturing-gdp-philippines/

Quarterly National Accounts Linked Series. Philippine Statistics Authority. (2023b, May 11). https://psa.gov.ph/national-accounts/base-2018/data-series

Refashioner. (n.d.). Fetching fashion from Nice Homes. Refashioner. https://refashioner.com/

Rethinking business models for a thriving fashion industry. Ellen Macarthur Foundation. (n.d.). https://ellenmacarthurfoundation.org/fashion-business-models/overview

Segel, L. H., & Hatami, H. (2022, December 9). Shortlist: The State of Fashion 2023: Bright spots and darker patterns. McKinsey & Company. https://www.mckinsey.com/~/media/mckinsey/email/shortlist/204/2022-12-09b.html

Segunda Mana. A Spirit-led community free of poverty, committed to LOVE for the common good – Caritas Manila. (2022, September 2). https://caritasmanila.org.ph/segunda-mana/

Sell and buy clothes, shoes and accessories. Vinted. (n.d.). https://www.vinted.com/

Swap. (n.d.-a). https://swap.com/

Thredup (n.d.). https://www.thredup.com/

Ultrasuede® | TORAY. (2022). Beyond the material. Ultrasuede® | TORAY. Retrieved May 29, 2023, from https://www.ultrasuede.com/features/btm_01.html.

Vision of a circular economy for fashion. Ellen MacArthur Foundation. (2020). https://emf.thirdlight.com/link/nbwff6ugh01m-y15u3p/@/preview/1?o

Wearable tech company. Wearable X. (n.d.). https://www.wearablex.com/pages/about-us

WTO. (November 30, 2022). Share in world exports of the leading clothing exporters in 2021, by country [Graph]. In Statista. Retrieved May 29, 2023, from https://www.statista.com/statistics/1094515/share-of-the-leading-global-textile-clothing-by-country/

WTO. (November 30, 2022). Share in world imports of the leading textile importers in 2021, by country [Graph]. In Statista. Retrieved May 29, 2023, from https://www.statista.com/statistics/236426/share-of-the-leading-global-textile-importers-by-country/

Your affordable thrift and consignment store – online!. Swap. (n.d.). https://swap.com/

YouGov Philippines. (October 19, 2021). Leading fashion retailers in the Philippines as of August 2021, by index score [Graph]. In Statista. Retrieved May 23, 2023, from https://www.statista.com/statistics/1270839/philippines-leading-fashion-retailers-by-index-score/

Disclaimer: The views expressed herein or in any article in the UP ISSI website are those of the authors and do not necessarily reflect the policies or opinions of UP ISSI nor the views of the University of the Philippines. Regarding Accuracy of Information and Usage of Data: Visitors and users of the UP ISSI website are advised that information contained within the website is assumed to be accurate. However, errors can occur even with computer-generated information. UP ISSI makes no representation regarding the completeness, accuracy, or timeliness of such information and data, or that such information and data will be error-free. Visitors are encouraged to review the official version of all documents on which they plan to rely on.