POSITION PAPER ON HBN 8855:

AN ACT

INSTITUTIONALIZING DEVELOPMENT, ASSISTANCE AND MICROFINANCE PROGRAMS FOR LIVELIHOODS, ESTABLISHING AND PROMOTING ANTI-POVERTY AND INCLUSIVE GROWTH POLICIES WHICH ARE SUPPORTIVE OF MICRO, SMALL, AND MEDIUM ENTERPRISES (MSMEs), ALLOCATING FUNDS THEREFOR, AND FOR OTHER PURPOSES

By: Nova Z. Navo, NAST S&T Fellow

Micro, small, and medium enterprises (MSMEs) are widely acknowledged for their crucial role in fostering broad-based development, acting as the backbone of economies globally. This sector constitutes the majority of businesses and significantly contributes to employment, making it a vital player in shaping the economic landscape. Governments worldwide recognize the potential of MSMEs to create productive jobs, elevate living standards, and reduce inequality. This understanding has driven numerous initiatives aimed at developing a robust and dynamic MSME sector.

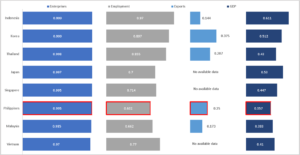

In the Asian context, MSMEs contribute 63 to 97 percent of all employment, 35.7 to 61 percent to gross domestic product (GDP), and 14 to 37.5 percent to exports.

Figure 1. Economic Contribution of MSMEs in select Asian countries

Philippine MSMEs in Perspective

Philippine MSMEs are generally classified based on their asset size and by the number of their employees. In terms of asset size, enterprises are grouped under micro if they have Php 3,000,000 or less in assets, small if they have PhP 3,000,001 to PhP 15,000,000; and medium, PhP 15,000,001 to PhP 100,000,000.

An enterprise is also considered a micro enterprise if it has one to nine employees, small if it has 10 to 99 employees, and medium if its employees number anywhere from 100 to 199. Businesses with bigger asset size and more number of employees fall under the large enterprise (LE) category.

Table 1. Enterprise Categories

| Enterprise Category | Asset Size | Employment Size |

| Micro |

Not more than Php 3 million |

Less than 10 employees |

| Small | Php 3,000,001 – Php 15 million | 10-99 employees |

| Medium | Php 15,000,001 – Php 100 million | 100-199 employees |

| Large |

More than Php 100,000,000 |

200 or more employees |

In the Philippine context, MSMEs mirror the ASEAN trend, albeit at the lower end of the spectrum.

MSMEs account for 99.5% of all enterprises in the country, accounting for over 60% of total jobs, and contributing 35.7% of value-added, indicating a need for increased productivity and professionalization. The sector’s representation as 60% of all domestic exporters yet contributing only 25% to the country’s total exports revenue further highlights the necessity for MSMEs to upgrade, diversify, and enhance their economic viability.

Figure 2. Distribution of Philippine Enterprises by Firm Size, 2012 and 2021

Furthermore, the dynamism observed in SMEs in other countries, such as Taiwan, does not seem to exist in the Philippines, suggesting the “unintegrated” nature of the country’s industrial sector (Balisacan and Hill 2003, 239). This lack of dynamism and integration raises concerns about the overall resilience and adaptability of the Philippine MSME ecosystem, further emphasizing the need for targeted and comprehensive interventions to address the challenges faced by this vital sector.

Micro enterprises dominate the Philippine business landscape, comprising a staggering 90.5% or 977,672 out of 1,080,638 total business establishments in 2021, according to official data from the Philippine Statistics Authority. Small enterprises follow with 94,008 establishments, making up 10.58%, while medium enterprises, with 4,444 establishments, have a share at 0.4%.

The low number of small enterprises and the almost negligible number of medium enterprises highlight the persistent challenge of the “missing or hollowed middle” phenomenon in the Philippine MSME structure. This phenomenon, observed as early as 2012 (Aldaba, 2012b), refers to the minuscule number of small- and medium-sized enterprises compared to the overwhelming preponderance of micro enterprises. The figures suggest that the number of medium-sized firms has stagnated despite the robust growth of the country’s economy in the years prior to the advent of the COVID-19 pandemic. This distribution has persisted over nearly a decade, resulting in a business landscape characterized by a “missing or hollowed middle” due to the limited presence of medium enterprises.

This accentuates the pressing need for a strategic and nuanced approach to uplift and invigorate the Philippine MSME ecosystem. As the backbone of the nation’s economic landscape, addressing these structural disparities is paramount to fostering a more balanced, resilient, and inclusive economic future.

Existing Policies for MSMEs

The country has a plethora of laws to promote and develop MSMEs. Foremost is the Magna Carta for MSMEs (RA 6977, as amended by RA 8299 and RA 9501) which highlighted the importance of MSMEs and outlined policies, programs, and even budgets to support the sector. Another is the Go Negosyo Act (RA 10644) which cemented the composition of the Micro, Small and Medium Enterprise Development (MSMED) Council, the government body primarily “responsible for the promotion, growth, and development of SMEs.” Its roles include: making policy recommendations to the President and Congress on SME-related matters; coordinating and integrating various government and private sector activities; working with local government units, National Economic and Development Authority (NEDA) and the Coordinating Council for the Philippine Assistance Program in tapping local and foreign funding—all to support the many facets of SME development.

The MSMED Council consists of government agencies such as the Department of Trade and Industry, the Department of Agriculture (DA), the Department of Interior and Local Government (DILG), and sectoral representatives- including those from the private sector. It is worthy to note that the Department of Science and Technology only sits in the Advisory Unit of the Council and is not granted voting rights. This is surprising considering the important role of technology in MSME development, and the country’s industrial strategy, emphasizing science, technology, and innovation as drivers for inclusive and sustainable industrial development.

Challenges faced by MSMEs

Despite the multitude of programs orchestrated by the government and the collective efforts of the MSMED Council, Philippine MSMEs confront formidable challenges that span diverse domains, including the need to improve the business climate, improve access to credit, enhance management and labor capacities, improve access to technology and innovation, and access to market (MSMED Council, 2018). Many argue that the lack of access to credit is among the most critical of these constraints.

Indeed, the SME literature is replete with studies (Aldaba, 2012a; Aldaba, 2012b; Caraballo, 2020; Cuaresma, 2020; Diaz, 2021; International Finance Corporation, 2017; Lopez, 2018; Maehara, 2012; Ramos, 2020; Velasco, et. al, 2017; World Bank, 2017) that show that access to credit is the most binding constraint faced by SMEs in the country. Moreover, capital raised by SMEs from the banking sector is only 10 to 21 percent, which contrasts with the experience in other Asian countries like India and Thailand that are able to meet the 30 percent international benchmark.

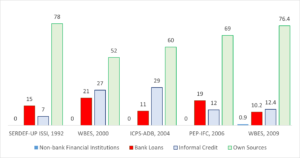

What this implies is that the bulk—or a range of 79 to 90 percent—of SME credit comes from elsewhere. This ‘elsewhere’ constitutes informal sources of credit for entrepreneurs such as their own personal resources, family/clan members, friends and informal lenders.

Figure 3: MSMEs’ Sources of Funding

This means that despite all of government’s combined efforts to provide credit to MSMEs—from government financial institutions (GFIs) like the Development Bank of the Philippines (DBP), the Land Bank of the Philippines (LBP), the Small Business Corporation (SBC), and other government agencies providing wholesale lending to private banks for MSMEs, direct MSME lending still falls pitifully short of covering the bulk of credit needs of the SME sector (Aldaba, 2012a). According to Aldaba, ‘estimates of the financial gap ranged from PhP 67 billion (or US$ 1.6 billion) according to the Philippine Exporters Confederation to the DTI’s estimate of PhP 180 billion (US$ 4.2 billion). It is this financing gap for MSMEs which has led to the ‘missing middle phenomenon’. The difference in the finance gap distribution indicate that micro enterprises face bigger challenges in terms of accessing formal credit.

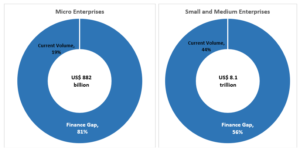

According to the 2017 MSME Finance Gap Report of the World Bank, the financing gap for MSME in developing countries is estimated at $5.2 trillion, which constitute about 59% of potential MSME demand. Although this differs according to the size of the firm. For micro enterprises, unmet demand for finance is 81% of potential demand, totaling $714.4 billion. While the gap for small and medium enterprises is at $4.5 trillion, which is 56% of the potential demand for the segment. (International Finance Corporation, 2017)

Figure 4: Potential MSME Demand Distribution

The International Finance Corporation’s regional analysis of potential MSME demand show that it is highest in East Asia and Pacific Region, where 58% of the total global potential demand is. Although this is mainly driven by the large demand and supply in China, which are at $4.4 trillion and $2.5 trillion, respectively, the gap is highest in the Philippines- if measured as percentage of GDP.

Figure 5: Formal MSME Finance Gap in Developing Countries

Even with the 10-year mandatory credit allocation for MSMEs under the Magna Carta for MSMEs, which was implemented until June 2018 (Bangko Sentral ng Pilipinas, 2018), the sector grapples with a dearth of loans. Lending institutions remain wary of the financial literacy and credibility of MSME borrowers, contributing to the credit crunch. Additionally, limited credit information hampers MSMEs’ access to vital programs, services, and assistance provided by financial institutions.

This is a major concern of the sector considering that limited resources impede MSMEs’ ability to innovate and adopt cost-effective production methods that usually entail technology upgrading. Inadequate infrastructure, high input costs, and the seasonality or instability of raw materials compound these inefficiencies.

In addition, obtaining or renewal of business licenses and permits remains a cumbersome, repetitive, and costly endeavor for MSMEs. Also, MSMEs face challenges in penetrating and sustaining their positions in competitive markets. Insufficient technology and a lack of technological skills hinder their competitiveness on both local and international fronts. Non-compliance with national and international standards further diminishes their ability to participate in global value chains and stifles export contributions. What is worse, as the third-highest disaster-risk country globally, the Philippines’ vulnerability to natural hazards poses a constant threat to MSMEs. Ensuring business continuity and swift recovery in the aftermath of disasters becomes a critical challenge.

Amid these persistent challenges, the provision of financing mechanism through the proposed PTK Five-Star Program is a welcome assistance from the government. There is likewise a compelling argument for Congress to play a pivotal role in fortifying the MSMED Council. Strengthening this entity, coupled with providing additional funding in accordance with its legislative mandate, becomes imperative to address the lingering concerns of MSMEs. Congress could consider leveraging its legislative authority to enhance the Council’s efficacy, ensuring it functions as envisioned by the Magna Carta and effectively tackle the multifaceted challenges faced by MSMEs.

Within this expansive support framework, the Department of Science and Technology (DOST) stands out as a crucial player. While currently contributing in an advisory capacity, elevating the DOST to a full-fledged member of the MSMED Council could harness its scientific and technological expertise more effectively. This adjustment ensures that the Council benefits directly from the DOST’s wealth of scientific and technological knowledge, reinforcing its role as a cornerstone in the comprehensive approach to MSME development.

This proposed adjustment aligns seamlessly with Section 3 of HBN 8855. This section mandates the DTI, in coordination with the DILG, DA, DOST, Department of Tourism (DOT), National Economic and Development Authority (NEDA), and the Technical Education and Skills Development Authority (TESDA), to develop a comprehensive program for MSME development in all regions of the country. Harmonizing efforts across these entities becomes essential for Congress to consider, preventing duplication of functions and avoiding unnecessary additional expenses for the government. This strategic alignment ensures a unified and streamlined approach toward empowering MSMEs, minimizing inefficiencies, and maximizing impact.

The Role of Academia in MSME Development

The Triple Helix Model, emphasizing collaboration among government, academia, and industry, is a proven framework for fostering innovation and economic development. In this context, the inclusion of representatives from the Academia in the MSME ecosystem is paramount. The Academe brings research capabilities, educational resources, and a pool of skilled graduates that can significantly contribute to the growth and innovation of MSMEs.

Higher Education Institutions (HEIs) can serve as incubators for new ideas, research and development hubs, and providers of specialized training programs tailored to the needs of MSMEs. Their involvement ensures a knowledge-sharing mechanism between academia and industry, fostering a dynamic and responsive environment for MSMEs to thrive.

In line with the Triple Helix Model, we strongly recommend the inclusion of representatives from the Academe in the implementation and oversight of the PTK Five-Star Program. Their representation will ensure a holistic and synergistic approach to the development of MSMEs, addressing not only immediate challenges but also fostering a culture of innovation and continuous improvement. HEIs can contribute in the following ways:

- Conducting research to identify emerging trends and opportunities in MSME sectors.

- Offering specialized training programs to enhance the skills of MSME proprietors.

- Facilitating technology transfer and innovation initiatives to improve the competitiveness of MSMEs.

- Collaborating with regional MSMEs to develop region-specific strategies based on academic insights.

Apart from the agencies mentioned in Section 3 of the bill, we propose that the Academe should have representation in the development and execution of the PTK Five-Star Program. Including higher educational institutions in policy formulation and decision-making processes will bring forth a more comprehensive and informed approach to the challenges faced by MSMEs.

__________________

References

Aldaba, Rafaelita M. 2012a. “Small and Medium Enterprises’ (SMEs) Access to Finance: Philippines.” Philippine Institute for Development Studies Discussion Paper Series No. 2012-05. Makati City: Philippine Institute for Development Studies.

_____. 2012b. “SME Development: Narrowing the Development Gap in the ASEAN Economic Community.” Philippine Journal of Development 39, nos. 1–2: 143–69.

Balisacan, Arsenio M., and Hall Hill. 2003. The Philippine Economy: Development, Policies, and Challenges. New York: Oxford University Press.

Caraballo, Mayvelin U. 2020. “Banks Fell Short of Mandated MSME Lending in 2019 – BSP.” The Manila Times, May 4, 2020. https://www.manilatimes.net/2020/05/04/business/business-top/banks-fell-short-of-mandated-msme-lending-in-2019-bsp/ 722083/.

Cuaresma, Bianca. 2020. “PHL Banks Lend the Least to MSMEs Among Asean-5.” Business Mirror, October 23, 2020. https:// businessmirror.com.ph/2020/10/23/phl-banks-lend-the-least-to-msmes-among-asean-5/.

Diaz, Rolando Ramon. 2021. “Rebuilding MSMEs in the Time of the Pandemic and Beyond.” Lecture. presented at the University of the Philippines Center for Integrative and Development Studies Webinar – Philippine Public Policy in a Time of pandemic: Confronting the COVID-19 Challenge, April 8.

Espenilla, Nestor. 2013. “Talking Points for Deputy Governor Nestor A. Espenilla Jr. for the Interview with Business World on SMEs.” May 15, 2013, unpublished document.

Habito, Cielito F. 2014. “Pitching in for Inclusive Growth.” No Free Lunch, Philippine Daily Inquirer, September 2, 2014. http://opinion.inquirer.net/78077/pitching-in-for-inclusive-growth.

_____. 2015. “Nurturing SMEs, the Japanese Way.” No Free Lunch, Philippine Daily Inquirer, March 3, 2015. http://opinion.inquirer. net/83007/nurturing-smes-the-japanese-way.

International Finance Corporation. 2017. MSME Finance Gap Assessment of the Shortfalls and Opportunities in Financing Micro, Small, and Medium Enterprises in Emerging Markets. World Bank.Lim, J. A. (2012). ‘Institutional Issues Concerning Industrial Policy for the Philippines: Learning from Other Countries’. Quezon City: Action for Economic Reforms. Available at: http://aer.ph/industrialpolicy/wp-content/uploads/2012/11/Insti-Issues-in-IP.pdf. Accessed: 22 March 2014. pp. 2, 4.

Lopez, Melissa. 2018. “Big Banks Fail to Meet Required MSME Lending.” Business World Online. October 9, 2018. https://www.bworldonline.com/big-banks-fail-to-meet-required-msme-lending/.

Maehara, Yasuhiro. 2012. “The Role of Credit Risk Database in SME Financing.” In The 25th Anniversary Publication of Asian Credit Supplementation Institution Confederation (ACSIC): The 25-Year History of ACSIC, edited by the Asian Credit Supplementation Institution Confederation, 48–68. Tokyo: Japan Finance Corporation.

“‘Magna Carta’ for MSMEs Yielding ‘Parvi Eventus.’” 2022. The Manila Times. January 6, 2022. https://www.manilatimes.net/2022/01/06/opinion/editorial/magna-carta-for-msmes-yielding-parvi-eventus/1828347.

“Mandatory Allocation of Credit Resources to Micro, Small, and Medium Enterprises Manual of Regulations.” n.d. Bangko Sentral ng Pilipinas. Accessed February 1, 2022. https://morb.bsp.gov.ph/332-mandatory-allocation-of-credit-resources-to-micro-small-and-medium-enterprises/?pdf=1930.

Bangko Sentral ng Pilipinas. 2018. Review of Manual of Regulations for Banks. Available at: https://www.bsp.gov.ph/Regulations/MORB/2018_MORB.pdf. Accessed: 01 February 2022. Section 332, p. 36.

MSMED Council. 2018. “MSME Development Plan 2017-2022: Accomplishment Report 2018.”.

OECD (Organization for Economic Cooperation and Development) and ERIA (Economic Research Institute for ASEAN and East Asia). 2018. SME Policy Index: ASEAN 2018; Boosting Competitiveness and Inclusive Growth. Paris: OECD Publishing.

Philippine Development Plan 2017-2022. n.d. National Economic and Development Authority.

PSA (Philippine Statistics Authority). n.d. “Annual Survey of Philippine Business and Industry—Manufacturing” (All Releases). Accessed August 20, 2020. https://psa.gov.ph/ manufacturing/aspbi.

Ramos, Marissa Mae M. 2020. “Banking on MSMEs: Making Business Loans Easy.” Business World, February 24, 2020. https:// www.bworldonline.com/banking-on-msmes-making-business-loans-easy/.

Republic Act No. 6977, “An Act to Promote, Develop and Assist Small and Medium Scale Enterprises through the Creation of a Small and Medium Enterprise Development (SMED) Council, and the Rationalization of Government Assistance Programs and Agencies Concerned with the Development of Small and Medium Enterprises, and for other Purposes.” 1991.

Republic Act No. 8289, “An Act to Strengthen the Promotion and Development of, and Assistance to Small and Medium Scale Enterprises, amending for that purpose Republic Act No. 6977, otherwise known as the ‘Magna Carta for Small Enterprises’ and for other purposes.” 1997.

Republic Act No. 9178, “An Act to Promote the Establishment of Barangay Micro Business Enterprises (BMBEs), Providing Incentives and Benefits therefor, and for other purposes.” 2002.

Republic Act No. 9501, “An Act to Promote Entrepreneurship by Strengthening Development and Assistance Programs to Micro, Small and Medium Scale Enterprises, amending for the purpose Republic Act No. 6977, As Amended, otherwise known as the ‘Magna Carta for Small Enterprises’ and for other purposes.” 2008.

Republic Act No. 10644, “An Act Promoting Job Generation and Inclusive Growth through the Development of Micro, Small, and Medium Enterprises.” 2014.

Shinozaki, Shigehiro, and Lakshman Rao. 2021. “ADBI Working Paper Series COVID-19 Impact on Micro, Small, and Medium-Sized Enterprises under the Lockdown: Evidence from a Rapid Survey in the Philippines Asian Development Bank Institute.” ttps://www.adb.org/sites/default/files/publication/677321/adbi-wp1216.pdf.

“The Philippine Banking Sector Outlook Survey, Second Semester 2018.” n.d. Bangko Sentral ng Pilipinas – Supervisory Policy and Research Department.

UNRISD. (2010). Combating poverty and inequality structural change, social policy and politics. Geneva: United Nations Research Institute for Social Development, pp. 2, 3, 4-5, 15, 16, 31, 41, 43-44, 54-55, 135, 136, 137, 148, 149, 257, 257-258, 261, 269, 273, 279, 281, 284, 287-288, 290, 292.

Updated Philippine Development Plan 2017-2022. n.d. National Economic and Development Authority.

Velasco, A., Castillo, P., Conchada, M. I., Gozun, B., Largoza, G., Perez, J., & Sarreal, E. (2017). Philippine Entrepreneurship Report 2015-2016. De La Salle University Publishing House.